Deep Energy Roots:

Boasting over 17,000 onshore wells and a history of producing 3B barrels of crude oil to date.3

Minimum investment:

Maximum raise amount:

Price per Security:

Target offering amount:

Security type:

Deadline to invest:

on Shares from Nov – December

Price per Security:

on Shares from December - January

Price per Security:

on Shares from January - February

Price per Security:

on Shares from February - March

Price per Security:

anticipated five-year net production anticipated revenue†

was invested in the past into this Perryland asset by 3rd party entities which Greenflame intends to leverage on

annual free anticipated cash flow generation with $3M capital expenditure‡

barrels of recoverable reserves of bypassed or unrecovered oil on Parrylands Block E to date

wells in place for oil extraction andexisting pipeline in place for crude sales

years of in-country operating team experience

that champions global shift towards a greener future through proven EOR and CCS collaboration

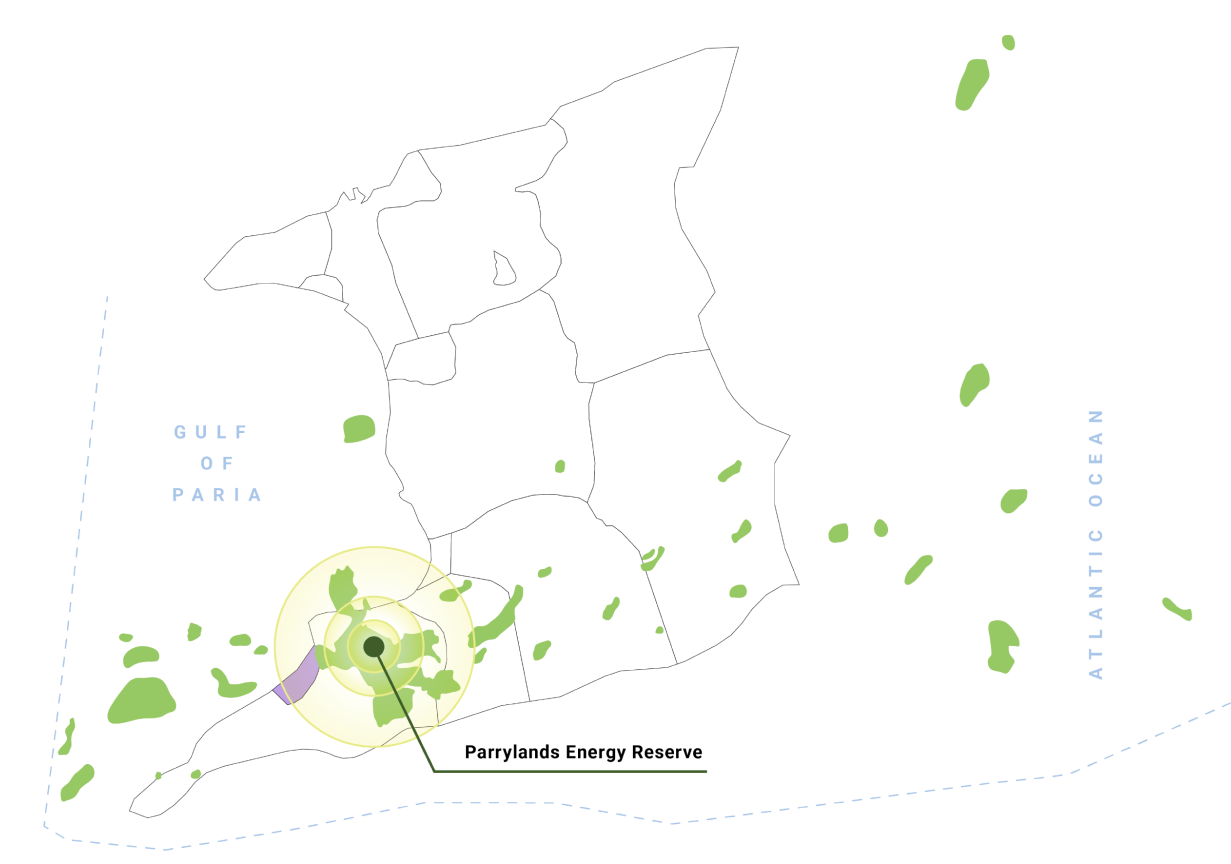

Trinidad and Tobago, known for its stunning beaches and vibrant culture, also has a rich history in the oil and gas industry, dating back to 1924 when the country’s resources became an extension of the world-class petroleum Guyana and Venezuela Basin deposits. Today, Trinidad and Tobago is the sixth-largest gas-producing nation in the world and one of the largest producers of Liquefied Natural Gas (LNG).

Oil Fields

Point Fortin: Location of Atlantic LNG Facility

Deep Energy Roots:

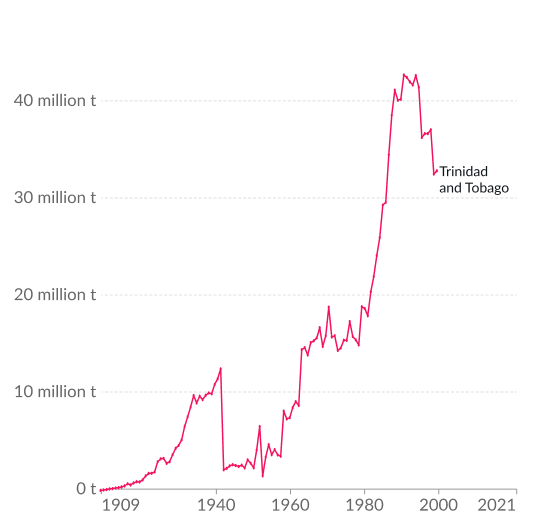

Boasting over 17,000 onshore wells and a history of producing 3B barrels of crude oil to date.3

Growth Prospects:

The market for oil and gas upstream in Trinidad and Tobago is poised to grow at a CAGR of 4.4% between 2020-2025.4

Economic Powerhouse:

As the third-richest country in the Americas by GDP per capita, Trinidad and Tobago derives 40% of its GDP from the oil and gas sector.5

Touted as the ‘Next Guyana’:

Energy giants like Exxon, British Gas, BP, and Chevron, have invested billions in Guyana’s energy sector. Trinidad and Tobago, with estimated 800,000+ barrels of equivalent oil, is emerging as the next big investment hub.6

Annual CO2 emisions7

Carbon dioxide (CO2) emissons from fossil fuels and industry

Greenflame’s vision is to support decarbonization and meet the world’s ever-growing need for more safe, secure and abundant energy while maintaining a commitment to the highest standards of safety and stewardship for its employees and the environment.

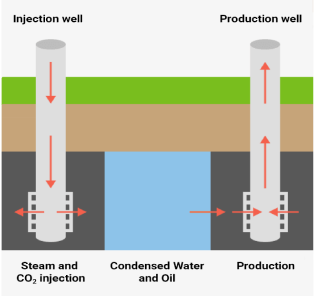

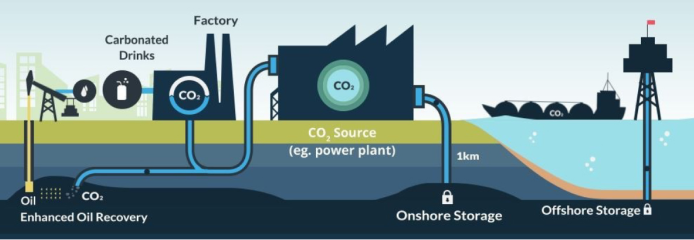

Greenflame’s solution uses two green technologies, Enhanced Oil Recovery and Carbon Capture and Sequestration, to drive value for its stakeholders. Its proprietary process injects CO2 emissions into the reservoir, effectively sequestering CO2 and increasing oil production at the same time, a win-win for the environment and Greenflame’s investors.

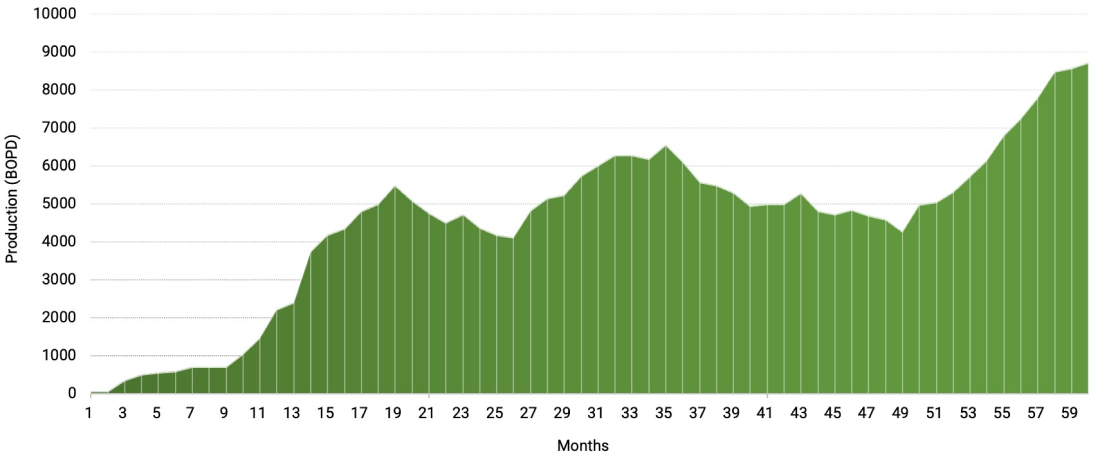

Greenflame's Five Year Production Outlook

– Billie Richards, Founder and CEO of Changeblock

744-acre Block E Concession:

An area rich in oil reserves on the southern tip of Trinidad and Tobago.

15-mile Petrotrin Pipeline:

Connecting the field to the Point Fortin Refinery, allowing for sea export and ensuring oil sales are directly facilitated without any bottlenecks.

Approved ‘Right Of Way’ Agreement:

With the Atlantic LNG Facility for a 7-mile pipeline that will provide access to a cost-efficient and plentiful supply of pure CO2 to leverage for both EOR and CCS.

Optimized Oil Extraction:

Made possible through the 110 existing wells with the potential to harness an additional 81 million barrels of oil.

High Production Potential:

Parrylands lies adjacent to Texaco’s property, which has realized 50% recovery of its oil reserves using thermal EOR. This means the Parrylands asset is highly receptive to EOR using Greenflame’s proprietary, cost-efficient process of steam and heat combined with CO2.

Production Estimates for Parrylands Block E Project

| Reserve classification | Gross MMBBL estimate | Reserve classification |

|---|---|---|

| Total Proved (1P) | 3.20 | Most conservative estimate |

| Proved + Probable (2P) | 12.95 | Moderate estimate |

| Proved + Probable + Possible (3P) | 32.45 | Least conservative estimate |

*By submitting this form, you consent to receiving email and SMS communications from GreenFlame Resources Inc. We respect your privacy and assure you that your information will be handled in accordance with our privacy policy.

Low Risk Project:

Harnesses the potential of existing wells and infrastructure in low-risk jurisdiction.

Potential for Carbon Neutral Oil Extraction:

Made possible by the implementation of Carbon Capture and Sequestration (CCS).

Minimal Capital Expenditures:

By leveraging EOR and existing well infrastructure.

Two Dividend Streams:

Income driven by oil production and carbon credits.

Expansion Potential:

Business model scalable across southern Trinidad and throughout the U.S.

EOR technology in action

End-to-end CCS operations9

A symbiotic relationship: EOR assists with CCS

Extract oil and gas at a fraction of the cost

Extract oil and gas more sustainably

Promising Production Growth: Steady Year-over-Year growth in barrels produced per day, with a significant increase from 471 barrels per day in Year 1, to 5,414 in Year 5.

Expected Net Anticipated Revenue Increase: Net anticipated revenue demonstrates consistent growth, reaching $128M over five years of production, marking an upward trajectory from

$26.2M in Year 1.

Capital Expenditure (Capex): Capital expenditure remains relatively stable over five years of production, with Year 5 at $9.2M, indicating a balance in investment.

Predicted Consistent Profitability: Net profit before tax maintains an upward trend over five years of production, from $15.8M annually in Year 1, to $73.9M annually in Year 5, demonstrating consistent profitability.

$15M+ anticipated cash flow annually and substantial growth potential allowing Greenflame to pay a dividend on the profit to investors quickly.

Trade in carbon credits provides healthy anticipated cash flow through the carbon captured and sequestered in the ground.

At Greenflame, we prioritize reducing emissions while offering lasting value for our stakeholders by investing in low-carbon technologies and solutions. Through strategic partnerships, we champion the global shift towards green energy.

– Michael Astone, CEO of ArcStone Securities & Investments Corp.

Greenflame’s leadership has nearly two decades of uninterrupted business continuity in Trinidad and Tobago, showcasing a profound understanding of the local landscape, government relations and over 30 years of in-country operational expertise.

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise – you are buying a piece of a company and helping it grow.

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise – you are buying a piece of a company and helping it grow.

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Individuals over 18 years of age can invest.

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

The Common Stock (the “Shares”) of Greenflame Resources Inc. (the “Company”) are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

In the event of death, divorce, or similar circumstance, shares can be transferred to:

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@greenflameresource.com.

At a minimum, the company will be filing with the SEC and posting on it’s website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

Ask questions and share feedback with Greenflame’s team below.